In addition to varying mortgage rates – different home loans offer different features and what is best for you may not be the best for another home buyer. A home loan tailored to your financial situation can be as important as finding the right home that fits your lifestyle.

Understand your home loan better

The lending market offers a plethora of choices, deals and discounts when shopping for a home loan. Most homebuyers get caught up just searching for the lowest rate assuming that is the best value but that may not always be the case.

Two common features in home loans are an offset account and redraw facility.

Today, the majority of home loans offer offset accounts or redraw facilities. Some lenders are also offering these features with fixed rate home loans.

These features allow you to use your savings to reduce your loan balance, which in turn save you money on the interest you pay on your mortgage. When you park your money in an offset account or use a redraw facility, you can access the extra cash you applied to your mortgage in the case of an emergency – so that you can utilise your savings optimally.

What is a redraw facility?

A redraw facility allows you to redraw the additional repayments made against your home loan. Depositing any spare money directly into your home loan account reduces your loan balance but reserves the option to ‘redraw’ the additional money as and when required.

For example, if you have a mortgage of $300,000 at an interest rate of 4.00% for 30 years, your monthly repayment would be $1,432.25. If you deposit $20,000 into your loan account, your balance will reduce to $280,000. Therefore, you’d be only be charged interest on $280,000 and you would be able to ‘redraw’ any additional funds from your mortgage when needed.

Note that some lenders may charge up to $50 for a ‘redraw’ or cap the number of free ‘redraws’, or the amount you can redraw in a year. Others waive their redraw fees when transacted online rather than via a branch.

What is an offset account?

An offset account is similar to a regular transaction account linked to your home loan. The benefit of using an offset account is that while you have full access to the money, the balance in your account is offset against your home loan principal daily, bringing down the amount of interest you pay.

Thus, the more the amount of money in your offset account, the lesser the interest you pay overall.

For instance, if you have a $300,000 home loan and $20,000 in a 100% offset account, you will only be charged interest on $280,000. However, compared to a redraw facility, you can maximise your savings with an offset account by having all of your salary paid directly into an offset account. This ensures that your unspent income is used to reduce the balance of your loan and you can also maintain a high balance for the maximum number of days. In short, it requires less maintenance than having to transfer funds into your loan as redraw.

Redraw vs offset

In terms of saving money on interest, a redraw facility offers the same benefits as a 100% offset account. So, how is one option better than the other?

Generally speaking, the only difference between the two options is that an offset account is, essentially, a savings account that gives you easier access to funds. Many of these accounts come with an ATM, and some may even have a credit card, making it simpler to withdraw money.

Redraws, however, often have restrictions in terms of the number of free redraws or the maximum amount you can redraw in a year. There may also be a lag via redraw from when additional funds are deposited into the loan to when they actually become available.

In terms of savings, either is fine, and the choice also depends upon your financial condition. Choosing an offset account makes sense if you have stable income and can maintain a decent balance in your offset account. Otherwise, a redraw facility works just as fine.

Tax implications

Just like with everything else, there are tax implications to both options.

If you are redrawing money from an investment property offset account for personal use, the interest on that amount would no longer be tax deductible.

Similarly, one should consider their loan structure when purchasing their first home. While amortising the debt as quickly as possible is ideal, there is a likelihood that the first home may become an investment property in the future if and when you decide to upgrade to a new home. It is at this juncture that the loan and repayment structure set up at the start becomes paramount.

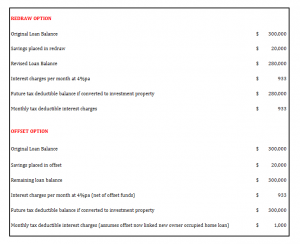

The deductible portion of your debt is based on the loan balance at the time the property was made available for rent. If you had used your redraw facility to accelerate your amortisation to pay more off the balance of your loan, you would have essentially eroded your tax benefits. However, if you had used an offset account instead, you would have still retained the balance of your loan at its highest limit which in turn maximises your future tax benefit. In the scenario below, the client retains an addition monthly tax deduction of $67 by utilising an offset account rather than a redraw facility with their original home loan.

In the above scenario, parking $20K of savings into an offset account instead of the loan / redraw has potentially added $67 a month in deductible interest should this property become an investment home.

To understand your options better, we would recommend speaking with your accountant or a mortgage broker before deciding on any loan structure.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice. DPM Financial Services Group recommends you obtain advice concerning specific matters before making a decision.