What beginners need to know about investing

With so much to consider before starting your investment journey, it can be an intimidating experience for beginners. Given the recent surge in market volatility following the global events of COVID-19, you may be thinking, is now the right time to enter the market?

When to start investing and how to start investing

Understanding both how to start investing and when to start investing are important steps to becoming a more confident and well-informed investor. The aim of this article is to educate you about the basics, so you feel confident in taking your first steps when the time is right for your personal circumstances. Time and time again, the evidence has shown that those who have held their investments through the regular ups and downs of the market have had a much better chance of avoiding losses and growing their wealth than those who tried to cherry pick when to buy and sell.

There are common concerns that often hold beginner investors back from making their first investment. These include: losing money, knowing when to start investing and no clear answer to the question “what should I invest in?”.

This article addresses these concerns within a framework that will help you understand how to start investing and building wealth.

Concern #1: investing presents a high risk of losing money

A common concern often brought up when beginners start investing is the risk of losing money. Losing money is what most beginner investors picture when they think of investing in the share market and the risk associated with that, when in fact the share market is not like gambling or a game of chance with professional guidance. Yes, there is always risk, like with any kind of investment, but you may have heard that additional risk needs to be taken in order to generate additional returns. However, this isn’t strictly the case either.

Two forms of risk associated with this belief are:

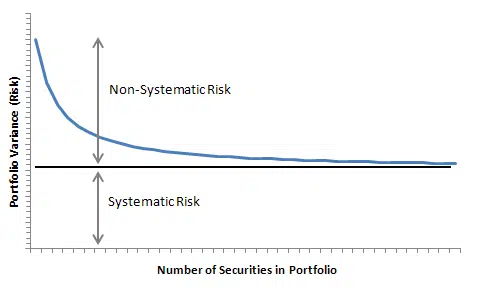

- Non-systematic risk which is unnecessary risk that does not deliver higher expected returns when taken; and

- Systematic risk which is necessary to take in order to generate higher returns.

Non-systematic risk explained

If you were to invest in only one company’s shares, there is a strong possibility that you could lose money due to a range of risks specific to that company. Risks such as, but not limited to, underperforming management; poor outlook or profitability results; carrying too much debt; or a business venture failing, leading the company to bankruptcy. These types of risks can severely impact the return generated on your investment and lead to short-term or permanent capital losses. As these risks are not associated with generating higher investment returns and are not necessary to take, a well informed investor will take steps to remove them.

Imagine if you split your share investments evenly between two companies; you would effectively halve your exposure to these non-systematic risks. If one company were to go bankrupt, only half your money would be exposed. And of course, this exposure would continue to fall as you add more companies into your portfolio. This is the basic principle behind diversifying your investments. When a portfolio is sufficiently diversified, the exposure to non-systematic risk is minimal. Portfolio analysts argue the optimal number of different company shares to hold is between 20 to 30 in order to be sufficiently diversified.

Systematic risk explained

The remaining risk in a well diversified portfolio is called systematic risk. That is, the risk of all company shares being impacted at the same time. Such risks include the COVID-19 global pandemic or a recession decreasing the profitability of almost all companies. Systematic risks are unpredictable and impossible to completely avoid. However, they are generally linked to the overall market or economy. Therefore, if the overall market/economy is growing over the long term, these risks will be negated over time. As such, having a sufficient amount of time to ride out these risks is a very important consideration before they are taken.

The chart below shows the impact of diversification to the risk of a share portfolio:

(Source: WordPress)

It is based on a portfolio that only contains shares. Given other types of investment assets sometimes outperform shares and provide downside protection, an important consideration is including different types of investments in a portfolio. For example, the risk of energy prices rising may affect the profitability of most businesses. However, this would have less of an effect on property investments that depend on rental income alone.

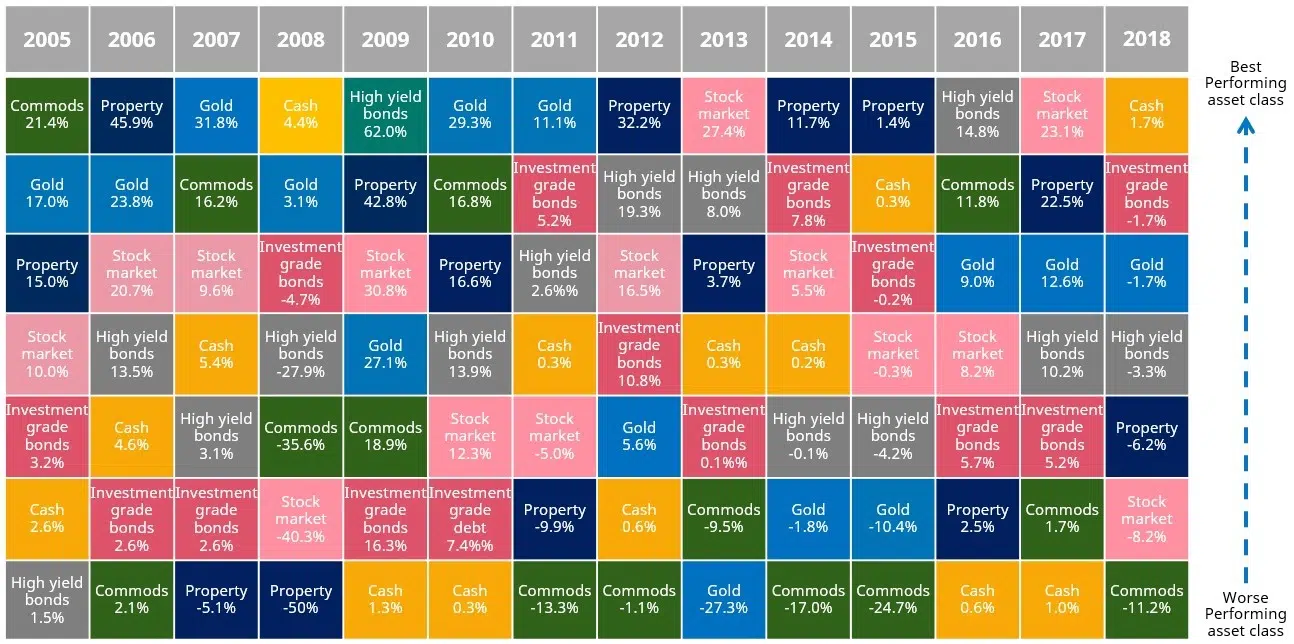

The chart below shows the annual returns for a range of different types of investments ranked by performance and ordered by year.

(Source: chart from Schroders)

You can see in the chart above, there is no discernible pattern as to which type of investment will be the highest performer. Therefore, when beginner investors ask the question “What should I invest in?”, the answer will generally not be as straightforward as they expect it to be. This is because, ideally, multiple types of investments should be held. By holding multiple types of investments, the better performing investments can offset those which did not perform so well in any given year. This will generally smooth out your investment portfolio’s overall returns each year.

Concern #2: Not knowing when to start investing

All investors want to “buy low and sell high”. However, the more successful method on how to achieve this may be different to what you might initially think. Empirical research has demonstrated that time in the market can be significantly more valuable than timing the market.

When investing, it is tempting to try and buy low and sell high at the ‘right time’. However, in doing so, it may prevent the investor from properly engaging in the market. Attempting to time market entry may mean the investor potentially finds themselves out of the market when the market actually rises. The price of a share over a 2-3 year period can fluctuate but the long term returns are far more predictable.

The strategy of regular investing, irrespective of market valuations, has historically provided strong long term returns. This is because it takes advantage of compounding and dollar cost averaging to drive long term performance as opposed to market timing strategies which can miss out on these benefits.

One analysis conducted by Peter Lynch, showed that in a 30 year period, if an investor were to invest $1,000 a year when the market was at its highest point each year, the compound annual return would have been 10.6%. If the purchases were made at the lowest point each year, the return would have been slightly higher at 11.7%. Given the minimal difference between these two extremes, one can argue the benefits of market timing adds little value over the long term.

A major benefit of a buy-and-hold strategy is it inherently takes advantage of compounding returns, particularly when investment distributions, such as dividends, are reinvested. By adopting this strategy, you will be taking advantage of the long term uptrend in the market to maximise your returns.

However, it is not just compounding returns which will help maximise the long term performance of your investment account. When you are starting out on your investment journey, a core financial goal is often building wealth over the long term. Therefore, it is common practice to invest cash savings on a regular basis. The process of investing the same amount of money at set intervals over a period of time is known as dollar cost averaging. By making regular investments in this way, you will average out the cost of your investment. This will further diminish the importance of your original market entry price.

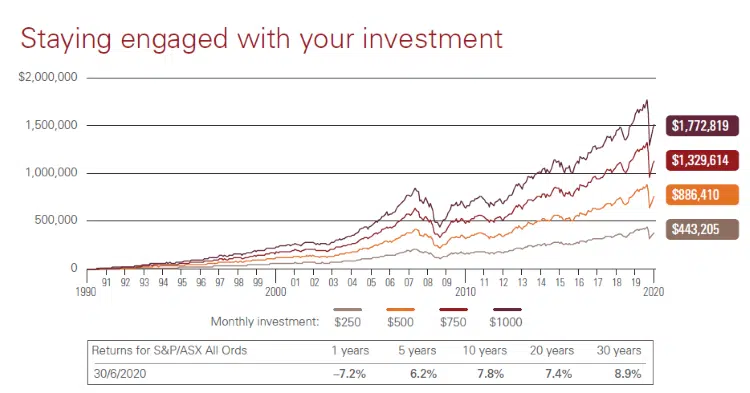

An effective way to illustrate the benefits of a buy-and-hold strategy is to calculate how investment balances can build over the long term using a combination of regular investments, dollar cost averaging, reinvesting distributions as well as taking advantage of compounding these returns.

Source: Andex Charts Pty Ltd. Data based on annualised returns since 1990.

The chart above shows, if you started investing $1,000 a month from 30 June 1990, your investment account balance would now be more than $1.77 million, after investing a total of $360,000 from your monthly savings. That’s despite the sharp fall in share markets in early 2020.

Looking back at the trend, it would have been beneficial to sell your investments before the market downturn which occurred in early 2020. However, we can only make these observations in hindsight as it is impossible to predict when a market downturn will occur. The danger of trying to sell when the market is at its peak assumes the risk of missing a high-performing period which may follow the downturn. A Charles Schwab research project modelled over a 20-year period found that a market timing strategy would need to be accurate at least 74% of the time to beat the index. Even professional fund managers who attempt to time the market rarely have such high accuracy. The increased trading activity can also lead to extra costs, which will decrease your net returns, compared to a buy-and-hold strategy.

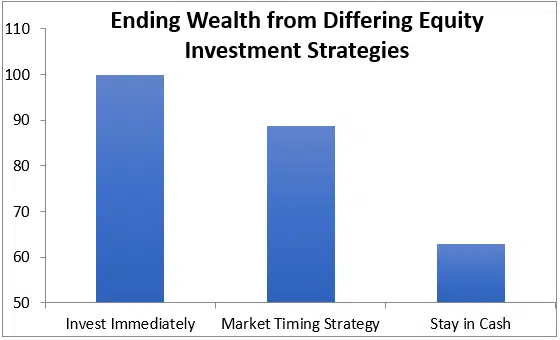

According to the Charles Schwab research project, an investor who attempted to time the market generated around 10% lower returns on average than an investor who put $2,000 every year into shares and remained fully invested. Those who stayed in cash (another form of market timing) performed the worst.

(Source: Dominion)

An important factor to consider for those just starting out, is you will usually have an initial lump sum of cash to invest. In this scenario, you may choose to split the lump sum and invest at set intervals over a period of time, as per a dollar cost averaging strategy. Because you can’t determine how the market will perform from one day to the next, implementing this strategy can mitigate the risk of investing while share prices are at a short term peak.

Concern #3: What should I invest in?

Hot investment tips can come from all directions when asking for recommendations. One of the reasons why so many people can chime in with different answers is there is no ‘one size fits all’. The answer to this question has to relate back to your goals, personal circumstances and level of risk tolerance.

The first consideration to make when determining where to start investing should always relate to your level of risk tolerance. It may be appropriate for your circumstances to invest a large portion of your savings into the share market. However, if you are the type to lose sleep worrying about potential losses, this option is likely unsuitable for you.

The second consideration is your ability to take on risk. As your investment timeframe decreases, so should your exposure to volatile assets such as shares and property. This is because, in the short term, there may not be a sufficient amount of time to ride-out market volatility before you need to redeem the investments to fund your lifestyle. However, if you have a longer time horizon, you may seek exposure to risk with the expectation of long term growth.

This is where a financial adviser adds value. Before you get started constructing a portfolio, your adviser would help to determine the level of risk you are comfortable with and the level that is required to meet your goals. For example, you may be willing to take on a high level of risk because you have a long investment horizon, you are experienced with investment markets and you have reliable income sources. However, it may not be necessary for you to have exposure to risky assets if a more conservative portfolio can meet your goals.

Investment assets can be roughly categorised into two classes: growth and defensive assets.

Growth assets include property and equity while defensive assets include cash and bonds (fixed interest). Growth assets tend to be more volatile and although they historically have better long term growth prospects, they generally come with a greater risk of losing value in the short term. Defensive assets are more conservative, as the value is linked to the income it generates and the underlying value of the asset. Long term growth is generally lower for defensive assets but the downside risk is also reduced. The ratio of growth and defensive assets is a critical choice in the development of an individual’s investment portfolio.

Approximately 80-90% of investment returns are determined based on this asset allocation. From there, we recommend that well-proven asset classes are sought out (for example, shares from the US, Europe and Australia) while asset classes that are difficult to understand should be avoided. For example, private equity is a high risk asset class that may not be suitable for all investors. Financial instruments that are not understood not only risk the initial capital invested, but potentially other assets held in your name.

Your investing checklist

- Determine the level of risk appropriate for your investment account;

- Establish an appropriate growth asset / defensive asset ratio;

- Consider a well-diversified portfolio of shares and different types of investments;

- Once you implement a strategy aligned to your risk tolerance, financial goals and timeframe, stick to it;

- Start investing early and regularly to take advantage of dollar cost averaging and compounding returns over the long term;

- Be mindful of costs. Low-cost solutions can be found if you know where to look; and

- Investing for beginners starts with matching investments to risk tolerance, circumstances and goals. It is advisable to speak with a financial adviser to have these reviewed.

If you wish to speak to a DPM wealth adviser about starting your investing journey, call 1300 376 376 or book in for a complimentary no-obligation initial consultation.

Also read: Considerations for Socially Responsible Investing

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.