Qualification is within reach. So is financial security.

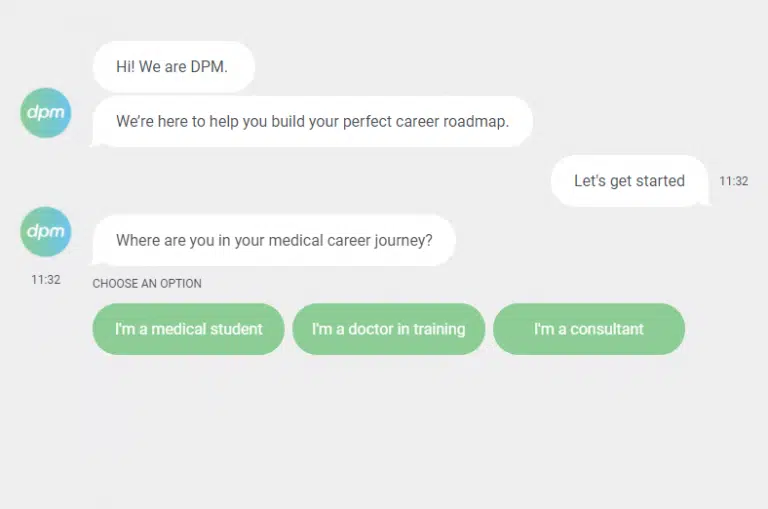

What is your career stage?

Plan for change. Embrace your future.

You’re busy working through your specialty program and gaining the necessary skills to practise that specialty independently. You’ve got a better idea about what life post qualification will look like and may be considering pathways such as fellowship or private practice.

With your income increasing, you’ve got a lot going on both personally and professionally. DPM is here to help you rise to the challenge of change and ensure you make appropriate financial decisions for now, and the long–term.

DPM's range of registrar services

Tax and Accounting

As you reach this career milestone you need to start getting smart about your tax. Our medical tax specialists will help you understand your tax obligations and optimise your tax position.

Personal Insurance

Our experienced insurance consultants are here to help review your personal insurance cover to ensure your growing professional, personal and family needs are met.

Private Wealth

As your medical career continues on its upward trajectory, it's important to consider investment strategies aimed at long-term wealth creation to target your financial goals.

Lending

Navigating the complexities of highly competitive lending options can be a frustrating experience. Our team have strong long-term relationships to help locate a suitable loan for you.

Property Advocacy

Bidpro's Property Advocacy service leverages their property experts to help you make a smart and informed property decision, allowing you to benefit from their vast experience and insights in order to make a purchase in line with your individual preferences.

Legal Services

With your career now hitting its straps, it's the time to seek legal advice across a range of matters including the preparation of Wills and employment contracts to protect your interests.

Time in the Market vs Timing the Market: The Power of Long-Term Investing

In the world of investing, there’s a perennial debate between “time in the market” and “timing the market.” While the latter involves attempting to buy

The Dangers of Social Media Finfluencers

In the fast-paced world of investing, it’s essential to have reliable sources of financial guidance. But what happens when these sources aren’t as trustworthy as

New Year’s resolutions for your finances in 2024

Are you sick of spending everything you earn or looking to save for a new car, a wedding or your first home? With 2023 done

Frequently Asked Questions

Bright Futures.

Better with the

right roadmap.

DPM offer financial services for doctors at each stage of their medical career.

DPM focuses on financial security and wellbeing through specialist advice to protect and grow your wealth.

Our client reviews

We’re proud of our expertise delivering financial services for doctors, and so are our clients.