In the world of investing, there’s a perennial debate between “time in the market” and “timing the market.”

While the latter involves attempting to buy and sell assets based on predictions of market movements, the former advocates for a more patient approach – purchasing assets and staying invested for the long haul. Studies and historical data have typically shown that the benefits of long-term investing often outweigh the potential gains from short-term trading. Let’s delve into why ‘time in the market’ can be a desirable strategy.

One of the most compelling arguments for long-term investing is the consistency of market growth over extended periods. Despite occasional downturns and economic crises, the stock market has historically demonstrated resilience and an upward trajectory over time.

How do crisis and recovery affect global markets?

Unforeseen global events can and will have an effect on markets. War, conflict, and crisis can cause uncertainty and instability, and therefore it’s often likely that in these times you’ll see a reaction in the market, even if short-lived. However, it’s important to be aware of what this can mean for your investments in the long term.

Let’s have a look at some of the recent global financial crises and what the fallout and recovery looked like.

Take, for example, the tech crash of the early 2000s, the Global Financial Crisis of 2008 and the COVID-19 pandemic in 2020. While these events caused significant market volatility and short-term losses, they were followed by robust recoveries.

Let’s examine this with some data. According to historical market performance, after the tech crash in 2000, the S&P 500 Index, a benchmark for the U.S. stock market, took about 6.5 years to recover its losses fully. The chart below highlights the value of the index in September 2000 was not achieved again until April 2007.

Similarly, following the Global Financial Crisis in 2008, it took approximately five years for the market to bounce back to pre-crisis levels.

In more recent times, during the COVID-19 pandemic, global markets experienced unprecedented volatility as economies grappled with lockdowns and uncertainty. The S&P 500 plunged by over 30% in early 2020. But remarkably, it rebounded swiftly and ended the year with a positive return. From the peak of the market in February 2020, it took a total of 6 months before the market found a new all-time high.

More recently we saw the 2023 banking crisis, where several small-to-mid-size US banks failed, leading to concerns of a global banking contagion. Rather than collapsing, within days markets had powered out of this news event, eventually leading to global all-time highs, including Japan’s Nikkei reaching levels not seen since 1989.

Short-term fluctuations can induce anxiety; however, historically, markets have had a remarkable ability to recover and thrive over the long term. These charts illustrate that despite the severity of downturns, the markets have consistently bounced back and continued their upward trajectory over extended periods.

This leads to growth markets being described as ‘climbing the wall of worry’, referencing bull market behaviour where, in the face of adversity and ongoing negative news events, markets can quickly recover and continue to exhibit strong growth.

Rather than being a cause for concern, the recovery and growth out of negative news displays market resilience and therefore overall strength. It should provide added confidence in the long-term direction of the market.

In such times, investors seeking to ‘time the market’ are often left to the sidelines having sold based on fear, waiting to feel comfortable before entering the market once more. These investors feel locked out as markets rise, with their capital remaining on the sidelines after missing the low asset prices. They wait and hope for a retracement as markets continue ever higher.

It is a game of psychology and, if you’re unable to dedicate time to research markets on a daily basis, most investors make ‘timing the market’ decisions based on emotions. This appears as ‘fear’ at the bottom of market cycles and ‘greed’ at the top, resulting in selling at the lows and buying at the highs. A recipe for disaster.

How does war and global conflict affect the markets?

Delving further into significant events such as global conflicts and the resulting market impact, research conducted by the CFA Institute reveals that since 1926, there has been a discernible trend in stock performance. The table below shows how markets have reacted to some of the major wars and geopolitical events of the past:

| Large Cap Stocks | Small Cap Stocks | Long Term Bonds | Inflation | |

| 1926 – 2013 Market Returns | 10.0% | 11.6% | 5.6% | 3.0% |

| Avg of all wars | 11.4% | 13.8% | 2.2% | 4.4% |

| World War II | 16.9% | 32.8% | 3.2% | 5.2% |

| Korean War | 18.7% | 15.4% | -1.1% | 3.8% |

| Vietnam War | 6.4% | 7.3% | 1.9% | 4.1% |

| Gulf War | 11.7% | -1.2% | 12.5% | 4.7% |

| One Day Fall | Total Drawdown | Days To Bottom | Days to Recovery | |

| All Geopolitical Events | -1.2% | -5.0% | 22 Days | 47 Days |

Large cap stocks exhibited an average return of 11.4% during wartime, compared to a general average of 10% over the entire period. Similarly, small cap stocks saw returns of 13.8% during wartime, contrasted with an average of 11.6% across the entire period for the overall market. Notably, periods of war coincided with an average inflation rate of 4.4%, whereas the average inflation rate over the entire period stood at 3%.

The correlation between warfare and market performance, along with its inflationary impact, presents an intriguing paradox. It’s important to acknowledge that each war is unique, eliciting varied responses from the markets.

How has the war in Ukraine affected markets?

Recent events, such as the Ukraine conflict, initially resulted in a 7% decline in the S&P 500 index in the subsequent weeks. Nevertheless, within a month, the market rebounded to levels surpassing those prior to the onset of the conflict. We can see a similar trend during the recent Israeli-Palestinian conflict.

In addition to the potential for capital appreciation, long-term investing offers other advantages such as compounding returns and reduced transaction costs. By reinvesting dividends and allowing investments to grow over time, investors can harness the power of compounding, where gains generate further gains. Moreover, by minimising the frequency of buying and selling, long-term investors can avoid spending extra money on transaction fees and the detrimental effects of awkward market timing.

In times of significant market downturns, it’s natural to feel compelled to take action by selling assets and moving into cash, driven by a desire to regain a sense of control amidst uncertainty. This reaction is often rooted in the psychological phenomenon known as “loss aversion,” where the pain of losses outweighs the pleasure of gains. However, the consequences of such actions can be severe because during periods of market volatility, the most lucrative days often coincide with the most challenging ones. It’s in times like these where trying to ‘time the market’ can produce wildly unpredictable results, both positive and negative and therefore should be approached with extreme caution.

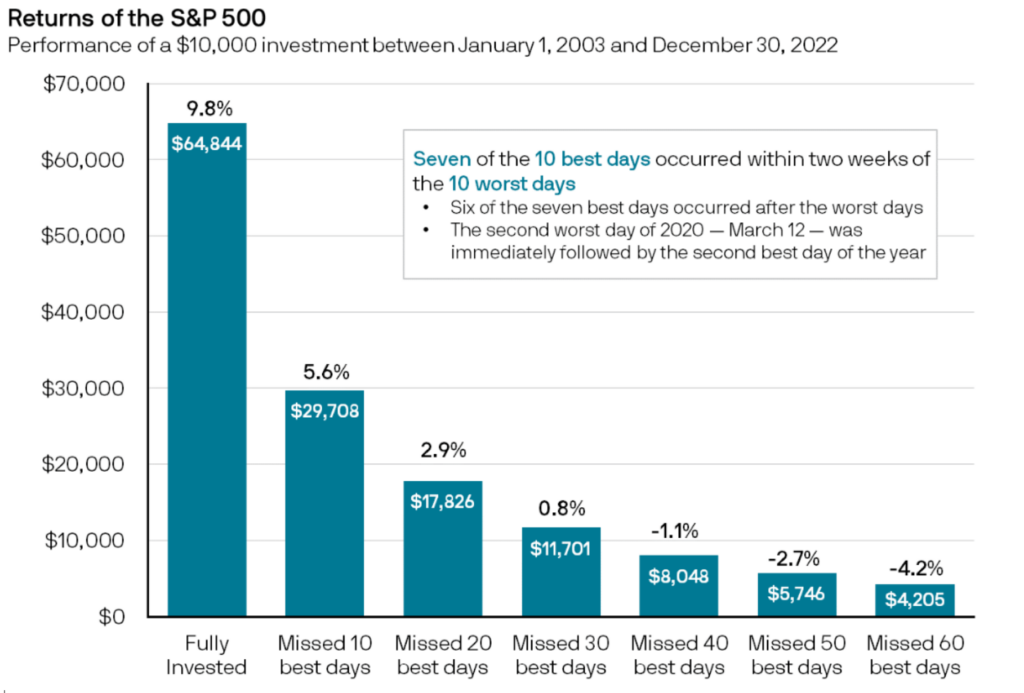

Consider the following comparison: an investor who remained fully invested in the S&P 500 over the past two decades versus those who missed out on key market upswings by being out of the market for certain periods. The impact of missing the top 10 best-performing days translated to nearly a 50% reduction in annualised returns. Moreover, missing the top 40 days resulted in an annualised return that turned negative on the original $10,000 investment.

In contrast, adhering to a steadfast approach with a diversified long-term investment strategy could lead to a more favourable outcome in terms of long-term wealth creation. This approach emphasises that staying committed to the chosen investment plan, even in the face of market fluctuations, increases the likelihood of capturing market upswings over time.

In conclusion, while timing the market may seem tempting with the allure of potential short-term gains, the evidence overwhelmingly supports the benefits of ‘time in the market’. By adopting a patient and disciplined approach, investors can navigate market volatility, capitalise on long-term growth opportunities, and achieve their financial goals.

It can be important to manage your emotions when it comes to investing. Having a strategy and sticking to it in times of uncertainty can be a great way to endure market downturns and global crises while continuing to grow your wealth.

If you’d like to have a chat to a specialist financial planner to discuss strategies for achieving your financial goals, we’d welcome you to book a free, no-obligation consultation with one of our Private Wealth Consultants.

Remember, successful investing is not about timing the market but rather time in the market.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.