Do you know what you can claim when it comes to your car?

As far as tax deductions in Australia go, including a claim for a motor vehicle is the most common in Australian taxpayer’s income tax returns.

Filter results by:

As far as tax deductions in Australia go, including a claim for a motor vehicle is the most common in Australian taxpayer’s income tax returns.

DPM is a company known for its values as much as its medical financial expertise. One of our core values is Recognition – showing gratitude

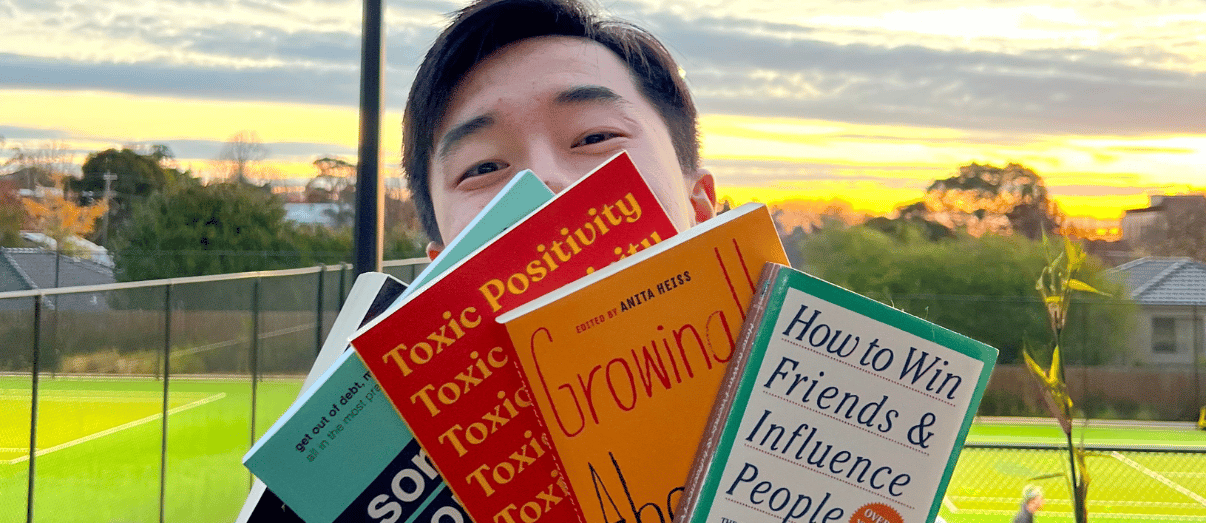

No, I don’t mean Guyton, Hall’s or Underwoods. I mean the books for medical students that really enrich your life, the ones that get you

There are a plethora of doctors working in private rooms, so what would make your medical practice stand out from the rest? Many practices seem

If you’re a final year medical student, you’re about to embark on one of the most important video interviews of your career. With just 15

Since the advent of the COVID-19 pandemic, the number of doctors taking up locum shifts, including at COVID clinics, has increased. Many doctors are travelling

The First Home Super Saver Scheme (FHSSS) passed parliament in 2017. Many first home buyers find the scheme confusing but it can be used effectively

During the last two years, the Australian insurance industry has seen some of the biggest changes in its history which may be relevant for Income

After completing tax returns for medical professionals for more than 50 years, our tax team has heard their fair share of misinformation that clients have

Often, many businesses that operate in the medical industry will acquire their medical rooms by using a separate entity to the one that runs the

So….. You have made it though 2021, managed to successfully pass your studies during a pandemic and begin your journey as a doctor. Congratulations on

Budgeting is probably one of the least exciting words out there for many people. But when you don’t earn a full-time income, it’s something you

Gain thorough knowledge and valuable advice on financial services tailored specifically to medical professionals.

DPM offer financial services for doctors at each stage of their medical career.

DPM focuses on financial security and wellbeing through specialist advice to protect and grow your wealth.