Here we are again! With the end of the financial year fast approaching, it’s that time of year to ensure that you are making the most of the planning opportunities available to you in the current financial year, especially when it comes to your superannuation account.

With significant changes to the superannuation landscape that came into effect on 1 July 2017, this new financial year is key. Indeed, what if we told you that it’s never been easier to top up your superannuation and claim a tax deduction for it.

Super contributions

Personal deductible

The current 2018 financial year is the first year that we are not bound by the 10% rule. This means that anyone under 65 (or between 65 and 75 who meets the work test) can make a personal deductible Super contribution towards the reduced $25,000 concessional contribution cap.

In the medical industry your source of income (public vs private) previously determined your ability to make additional super contributions (in addition to any 9.5% superannuation guarantee (SG) contributions) either by making a personal contribution or salary sacrificing via hospital payroll.

Under the new rules, specialists who generate more than 10% of their total income from public hospital salary can make an extra personal deductible contribution in addition to any 9.5% SG received up to the $25,000 contribution cap each year which adds significant flexibility and choice to your superannuation planning.

Example

Mary is an Anaesthetist Consultant working in a public hospital earning $350,000 plus SG as well as one day a week Private Practice with billings (after some expenses) of $100,000.

Given her contract, Mary’s SG is $20,049 (9.5% of the maximum SG salary of $211,040 p.a.). Under the previous rules, Mary would not have met the 10% rule ($350,000/$450,000 = ~78%) and she would have needed to salary sacrifice $4,951 to reach $25,000 concessional contribution cap.

Now Mary could avoid salary sacrifice and contribute say $5,000 as a personal contribution and claim a deduction of $4,951 against her total income. The excess amount of $49 not claimed would be treated as a non-concessional contribution.

Non-Concessional contributions

New rules now limit non-concessional (or post tax) Super contributions to $100,000 per annum per person (or $300,000 over a 3 year period if under 65 with a Total Superannuation Balance (TSB) of <$1.4m) but only if your TSB is under $1.6m per person.

Why are non-concessional contributions important?

These contributions are not taxed on entry to superannuation and more importantly investment earnings within superannuation are only taxed at 15% (dividends, interest, rent and realised capital gains on assets owned for less than 12 months) and 10% on realised capital gains on assets owned for more than 12 months. This is compared to the personal marginal tax rates of up to 47% and only a 50% discount (up to 23.5%) on realised capital gains on assets owned for more than 12 months.

For Consultants aged over 50 or with significant cash flow surplus, non-concessional contributions are an important long term planning strategy to maximise wealth in a low tax environment.

The new $1.6m cap and TSB regime can provide significant benefits as you can start earlier. As your superannuation can grow in excess of $1.6m due to investments but you are limited to commencing an income stream and further contributions at this level.

Finally the TSB limits are based on the 30 June balance of your fund each year. This means that opportunities to make further contributions in the future may be limited as your fund grows.

Income streams

Account Based Pensions

These income streams are still one of the most tax effective ways to generate an income, particularly after the age of 60! And, the investment earnings on any assets within the pension (subject to the $1.6m cap above) are completely tax free.

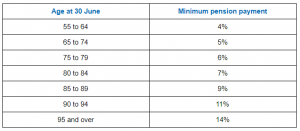

However, as per the table below, it is important to ensure you draw at least your minimum payment each year by 30 June to maintain the tax free status of your underlying investments.

Finally, if you are considering commencing a new Account Based Pension, you are not required to draw a minimum pension if you commence your pension after 1 June – which may be helpful if you are not reliant on the income generated from superannuation.

Transition to Retirement Income Streams (TRIS)

A TRIS enables you to commence an income stream while still working to generate additional tax effective income and previously enabled superannuation assets to move to a nil tax investment environment.

New rules that took effect on 1 July 2017 have removed the tax exemption on investment earnings within a TRIS for those age under 65 – unless a condition of release has been met (normally, it would be retirement).

These new changes have significantly reduced the effectiveness of a TRIS for those that are still working and TRIS may not be an appropriate strategy anymore – unless the additional income being generated is required.

If you are under 65, in a TRIS, and you are no longer working, you need to inform your fund trustee as soon as possible to ensure you are not paying more tax than you need to.

Future planning is crucial to ensure that you are taking advantage of the changing superannuation landscape.

Having a chat with a DPM Private Wealth Consultant is the best place to start if you need assistance with any superannuation planning for the coming financial year. It’s all quite complex and can get a bit confusing, if you need to talk to someone or have questions, call 1800 376 376 or alternatively, you can book an obligation-free appointment with one of our wealth advisers.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.