Everyone loves getting a good deal. It’s the feeling that drives us to regularly compare and switch service and product providers such as our mobile phones, general insurances and utilities. But what about your superannuation?

Superannuation is our compulsory retirement savings vehicle to which we regularly contribute but seldom pay any attention to the details. Superannuation is an investment structure that is too often overlooked but requires regular review to ensure you are getting a good deal.

The first question you may ask is ‘where do I start?’

A good place to start is to understand whether you have a choice of superannuation provider. Many medical professionals in the Public Health System will have a mandated superannuation fund (i.e. First State Super or Hesta) to which they must direct employer contributions. Whilst this limits your options, it is still imperative to do some research and understand where your superannuation will be invested and how much it will cost you.

These key details are available in the superannuation fund Product Disclosure Statement (PDS). You should have received a PDS when you joined the Super fund as it holds all the key information required for you to make an informed decision.

Investment Options

Normally, when you sign up to a Super fund you will be offered the default investment option – most commonly a ’Balanced’ investment profile. Generally, a ‘Balanced’ investment option has a 50% to 70% exposure to Growth assets and 50% to 30% exposure to Defensive assets. Some Super funds have an ‘Alternative’ asset class which could fall into either category. It is worthwhile doing a little research to find out what your money is invested in.

However, dig a little deeper and you will discover a choice of investment profiles that may include High Growth, Growth, Balanced and Conservative. The difference between the investment portfolios is the investment risk and volatility. High Growth investment portfolios will assume higher risk and therefore expect a higher return in terms of income and capital growth. However, in search of these returns, higher risk portfolios come with greater volatility and potential for negative returns. Defensive or less risky portfolios will focus on income only producing assets, thereby decreasing the expected return and volatility.

What’s important is understanding your ‘risk appetite’. Risk appetite refers to the amount of risk you are willing to take, i.e. exposure to growth assets that produce income and capital gains, for a certain expected return and volatility.

It is impossible to predict what investment markets will do therefore diversification is key to investing. Diversification means spreading risk among different investment assets to reduce the risk of exposure to one particular asset. It is important to get the mix of Growth assets and Defensive assets right for your risk appetite.

Fees

Super fees can be complex to understand mostly because there are many different fees associated with different Super accounts. You can group them into 2 different categories, fees that are charged directly to you and indirect fees that are not seen but are being paid.

Direct Fees

- Administration Fee and/or Membership Fee is charged for the administration of your Super account. It is either a percentage and/or a flat dollar fee and is deducted monthly from your Super cash account.

- Switching Fee is usually a flat dollar fee charged to purchase or sell investments or to change investment options, i.e. from ‘Balanced’ to ‘Growth’.

- Exit Fee a flat dollar fee charged to roll over your Super monies into another Super provider.

- Advice Fee is a flat dollar fee and/or percentage per annum usually payable monthly. If you have a financial adviser attached to your account, there is a chance you are paying them a fee to look after your Super account.

Indirect Fees

- Indirect Cost Ratio (ICR) and Management Expense Ratio (MER) are interchangeable. It is charged as a percentage of the overall balance invested in a certain investment option. It differs between investment classes and it is one of the most important fees to understand as the higher the investment fee, the more it eats into your return. It is deducted from the underlying investment and therefore you will not see this fee being drawn from your Super cash account.

- Buy/Sell spread refers to transaction costs incurred when buying and/or selling underlying investments within the chosen investment class. Similarly to the ICR, it is charged as a percentage and it calculated within the unit price of investment class therefore this fee will not be charged directly to your Super cash account.

- Performance Fee is charged by a fund manager for generating positive returns. It is calculated as either a flat dollar fee or a percentage of the profits generated. Some investment managers include the performance fee within the ICR so the percentage may be slightly higher.

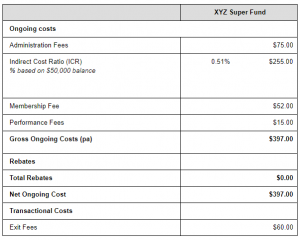

To further illustrate how they all add up, see the table below*. This is for illustration purposes only and based on a fictional scenario. All fees have been calculated on a Super balance of $50,000.

Fees matter. The cost of your superannuation fund can really add up overtime and will make a big difference to your end result as demonstrated by the graph below**. It illustrates the growth of $1mil at 6.5% p.a. return with varying 1%, 2% and 3% fees per annum (as a percentage of the funds invested).

As evident above, overtime, higher costs can impact the wealth accumulation of an investment portfolio. The higher the cost, the less you will have in retirement as fees erode your Super balance.

Still unsure about what to do? Don’t stress, DPM has a team of Private Wealth Consultants who are committed to helping you decipher all the financial jargon. Feel free to get in touch if you have questions about your Super.

*This scenario excludes the following fees: Adviser Commission, Adviser Service Fee, Brokerage Fee, Buy/Sell costs, Contribution Commission, Contribution Commission Rebate, Contribution Fee, Expense Recovery Fee, External Brokerage Fee, Initial Commission, Initial Contribution Fee, Insurance Commission, Insurance Premium, Investment Rebate, Less Initial Contribution Commission Rebate, Listed Securities Fees Per Transaction, Managed Funds Fee Per Transaction, Other Fees, Other Rebates, Portfolio Balance Rebate, Portfolio Construction Fee, Trail Commission, Trail Commission Rebate, Trustee Fees, Withdrawal Fees

**For illustrative purpose only. Assumes 6.5% annualised return over 30 years.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.