Child care subsidy changes – From 1 July 2018, the Child Care Rebate (currently limited to $7,613 a year for each child) and Child Care Benefit are to be abolished and will be replaced with a single payment, the Child Care Subsidy. The Child Care Subsidy will be paid directly to service provider.

Some basic requirements must be satisfied for an individual to be eligible to receive Child Care Subsidy for a child. These include:

- the age of the child (must be 13 or under and not attending secondary school);

- the child must be meeting immunisation requirements; and

- the individual, or their partner, meeting the residency requirements.

There are three means tests that will be applied to assess your eligibility for the Child Care Subsidy:

1. Combined family income

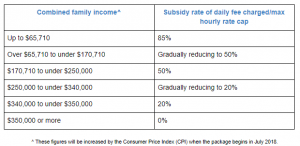

Under the Child Care Subsidy, the percentage of subsidy a family will be entitled to receive is based on their combined annual income, with more financial support available to lower income families.

The table below shows the percentage of child care fees the Government will contribute based on a family’s combined gross income:

Please note, doctors eligible for salary packaging through the Public Health System should ensure they consider their net reportable fringe benefit amount for the purpose of this income test. (i.e. $17,666 of reportable fringe benefits is taken as the net $9,010 for the purpose of this calculation.

Further, there will be an annual cap on the Child Care Subsidy available.

Under the new system, families with combined income less than $185,710 p.a., will have no cap on the amount of Child Care Subsidy they receive.

Families earning between $185,710 and $350,000 p.a., will still have an annual cap of $10,000 per year per child.

2. How much the parents work per fortnight, based on the activity of the parent who works least

As an extension to the combined family income test listed above, the work test per fortnight offers a varying number of subsidised childcare hours, based upon the parent who spends the least time working, training, studying or volunteering.

3. The type of childcare service utilised

The new system will set an hourly cap on the Child Care Subsidy dependent upon type of care provided. The hourly based subsidy is set at $11.55 an hour for centre-based care, $10.70 for family day care and $10.10 for out-of-school-hours care.

The final change is that previously you could elect to receive the rebate as a quarterly refund, having paid the full child care expense, or have the childcare provider charge their daily fees net of the rebate. Going forward the latter will be the only option, the subsidy will be paid directly to childcare providers to pass on in the form of reduced fees.

4. What does it mean for you?

Well, every situation is different so it is hard to say. The best way to assess how you will be impacted by the changes to the Child Care Subsidy is by using this Government’s calculator.

If you are unsure or have questions regarding the upcoming changes, talk to your financial adviser or alternatively, you can ask to speak to one of DPM’s Private Wealth Consultants on 1800 376 376 or book an obligation-free initial consultation here.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.