EOFY MYOB reporting & updating employee superannuation to 10%

If you have been using STP (Single Touch Payroll) to report your employee wages to the ATO, you will need to finalise the payroll year in your MYOB software after you have completed your final payrun for the year.

In addition you will also need to update the Super Guarantee rate to 10% for your employees.

Note: your final payrun in the 20/21 financial year is determined by the payment date of that pay, when the amount is paid to the employee from the business. Not the payroll period.

For example:

• If the pay period is from 15 June to 22 June – paid 25 June – that falls in the 20/21 year.

• If the pay period is from 24 June to 30 June – paid on the 1 July – this falls in the 21/22 year.

Once you have completed the pay runs that are paid on or before 30 June 2021, you can finalise the payroll for that year and report this finalisation via STP.

The finalisation of your payroll needs to be completed and sent via STP to the ATO by the 14th of July – at which time the employees MyGov account will show their Income Statement as ‘tax ready’ and will be green. They can then complete their tax return. If the employee cannot access their MyGov account, they can contact the ATO and request a copy of their income statement.

How to complete the EOFY finalisation report

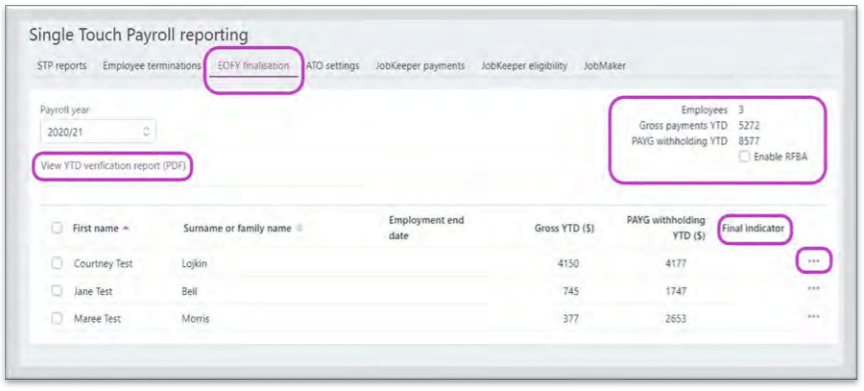

Go to Payroll Reporting Centre – EOFY Finalisation Tab

This tab represents the ‘Wages’ totals the ATO has in their system and you must reconcile the totals here with the totals you have just reconciled above.

What's next?

- Make sure you are on the correct year (2020–21)

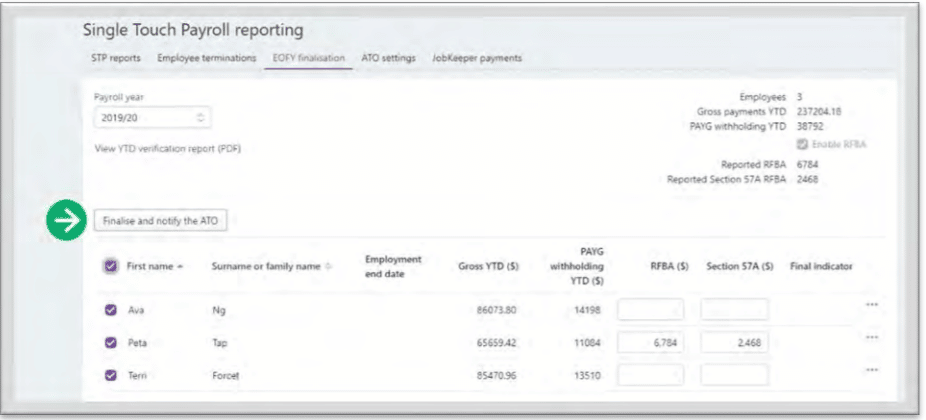

- After reconciling and ensuring that the amounts showing for the employee is correct, tick the employees that you wish to finalise (either individually or all at once)

A box will appear to Finalise and notify the ATO

Next steps

- Send this information to the ATO via the STP process – enter your name as the declarer

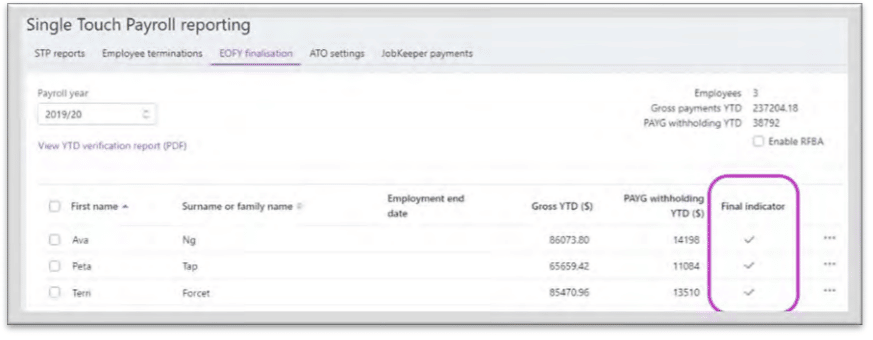

- Then the final indicator will appear as a green tick and click on this to submit to the ATO

Super Guarantee Increase to 10%

The Super Guarantee (SG) amount that a business needs to pay on an employees ordinary time earnings is increasing from the current 9.5% (where it has been sitting since 2014) to 10% from 1 July 2021 and is due to be increased further to 12% by July 2025.

Once you have completed your payroll for this current financial year and ensured that your information is correct (you may have finalised – but as this is not locked for completing future payroll this finalisation can happen later – as long as it is before the 14 July 2021), you will need to update your Super Guarantee percentage in your pay items list in your software.

This increase will not be completed behind the scenes like tax table updates happen within the software, hence the manual increase of this percentage attached to that Pay Item.

What version of MYOB Essentials are you using?

How to amend using old MYOB Essentials

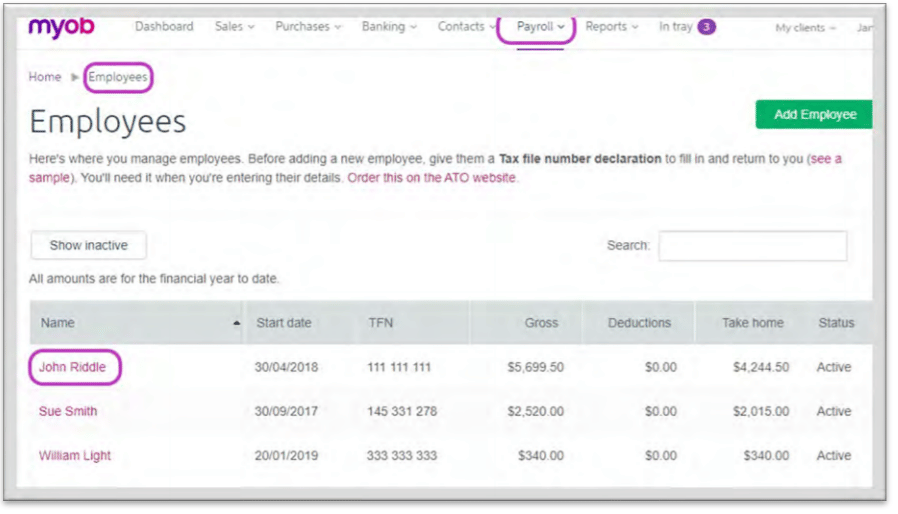

With this version of the Essentials product, the update of the Super Guarantee rate will need to be completed in each employee’s card. You will need to ensure that you are not amending any employee that is under 18 that should not be accruing any SG unless you are to calculate this for them dependent on what award you are under.

Steps to amend the SG rate for individual employees

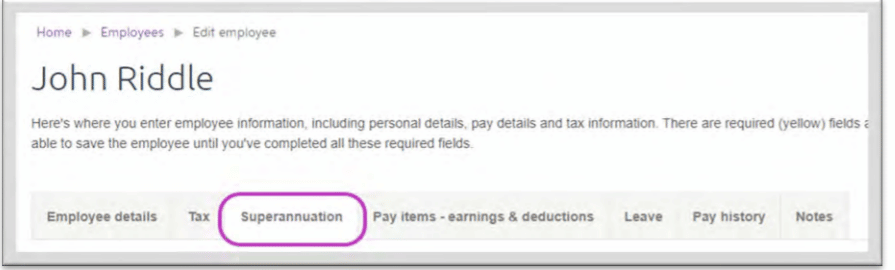

- Payroll tab

- Employees

- Select the employee you wish to amend from the list

- Go to the Superannuation tab

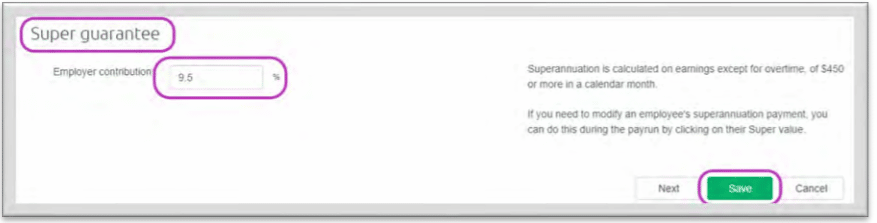

- Under the Super Guarantee heading

- The Employer contribution box

- Increase to 10%

- SAVE

How to amend SG rate using new MYOB Essentials

- Navigate to

- Payroll

- Pay Items

- Superannuation tab

- Select Superannuation Guarantee

- In the Super information

- The percentage box

- Change this to 10%

- SAVE

If you require any further guidance or assistance with your end of year reporting, book an appointment to speak with your tax adviser who will be happy to talk you through the process.