We live in a fast moving world. With the advent of modern technology, it’s easy to become overloaded with the volume of information and news available to you. This can cause you to worry about what this news might mean to you and your personal circumstances.

More often that not, the news presented to you is bad. Why? The most common view is that bad news is more interesting and attracts more attention. This does not necessarily mean that the news is something that you need to react to straight away.

One recent example of news that may impact Australian investors is the proposed policy to stop tax payers from receiving tax refunds for the franking credits they receive in conjunction with the dividends paid from Australian companies they own.

What does this mean?

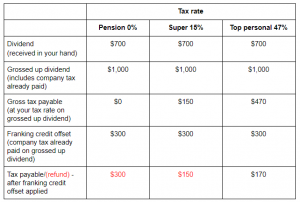

Under the Australian tax system, companies pay 30% tax on their profits. When these profits are passed on to shareholders in the form of dividends, the company also hands the shareholders a credit for the tax the company has already paid (the “franking credit”).

The individual shareholder then pays tax on the profit they received from the company, less the “franking credit”. This ensures that the company profits are taxed at a shareholder’s marginal tax rate.

The removal of the refund of excess franking credits would mean that low income earners (taxable income below $37,000 or 19% marginal tax rate) and superannuation funds (either 15% in accumulation phase or 0% in pension phase) would potentially receive less income from Australian shares, as the taxpayer would only receive a portion of the 30% franking credit to cover the tax liability (either 19%, 15% or 0%) and not the excess franking credit back as additional dividend income.

Australian Dividend Imputation

At face value, this proposal appears to be bad news for investors. However there are factors to consider before reacting to this news:

- This proposal is just that – a proposal by an opposition party. The Labor Party needs to win the next federal election and pass legislation through two houses of parliament before any changes are made.

- The franking credit system has given investors an incentive to invest more in Australian shares (particularly those that pay a high proportion of their profits as dividends) just to receive the franking credit. Any changes to franking credits may mean a shift in focus to other markets such as global shares, to achieve a suitable investment return. This may not be a bad thing as Australians tend to have a high home-bias toward Australian shares compared to other asset classes. This diversification can reduce investment volatility, but also the potential to mitigate any tax risks as foreign tax credits would not be impacted.

- Focus on total income not yield

There are two components to investment returns – income and capital growth. Many investors focusing on blue chip companies are investing purely for the income yield and are not concerned about capital growth. This income yield may not be sustainable as companies often need to reinvest profits back into the business to continue to grow. So while a high income yield may seem like a great idea, it may come at a cost as your income may not be necessarily growing as much as what it could. - Many superannuation investors have the opportunity to move between accumulation and pension phase to change the effective tax rate of their investments and utilise more of the franking credits associated with Australian shares (should the rules change).

So what should you do? Making knee-jerk reactions to short term news could mean unintended consequences for you over the long term that could cost you more than if you did nothing. So rather than jump at shadows, seek professional advice based on your goals and objectives so that you’re aware of all possible options.

At DPM Private Wealth, our focus is to understand your needs, help you cut through the noise and navigate the myriad of financial decisions so that you and your family achieve financial peace of mind. For a no cost or obligation initial consult, please contact us here

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.