Investing in the equity market can be an intimidating experience for a novice. Common concerns include losing money, when to enter the market and what to buy. This article addresses these concerns within a framework of understanding the risks & uncertainty around investing.

Uncertainty can be considered random and unpredictable, while risk can be measured, quantified and managed. By understanding the risks and how to mitigate them, you can be a more confident and well-informed investor.

Concern #1: Losing money

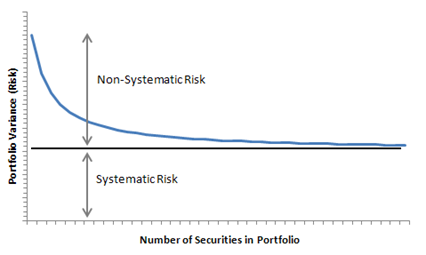

Let’s start with the worst case scenario: losing your money. If you were to buy only one security, there is a possibility that you could lose everything. However if you purchased one more stock in a different industry and country then you reduce your risk of losing all your money. As we add more securities to the portfolio and seek to diversify then the risk continues to drop.

Eventually, the number of stocks added to this portfolio will not necessarily provide any further decrease in risk. The chart below shows the impact of diversification on the risk to a portfolio.

The remaining risk in a well-diversified portfolio is considered systematic risk which is unpredictable and impossible to completely avoid. Portfolio analysts argue the optimal number of equities to be held is anywhere between 15 to 100.

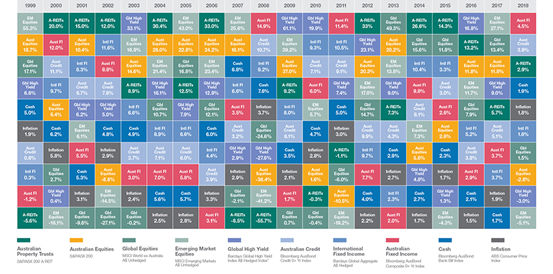

These analysts have only considered an equity-only portfolio. Given that other asset classes can outperform equities as well as provide downside protection, it is worthwhile considering adding these asset classes to any portfolio. The chart below shows the annual returns for a range of asset classes ranked by performance and ordered by year. Given that there is no discernable pattern as to which asset class will be the highest performing any particular year, it may be advantageous to include other asset classes in your portfolio.

(Source: chart from Schroders)

Concern #2: When to enter the market

All investors want to “buy low and sell high.” However trying to achieve this goal may prevent you from engaging in the market. Attempting to time market entry may mean that you find yourself potentially out of the market when the market actually rises. The price of a stock over a 2-3 year period can fluctuate but the long-term returns are far more predictable.

One analysis conducted by Peter Lynch, showed that in a 30 year period, if an investor were to invest $1,000 a year at the point when the market was the highest in that year, the compound annual return would have been 10.6%. If the purchases were made at the lowest point every year, the return would have been slightly higher at 11.7%. Given that none of us have the benefit of investing retroactively, the key learning is that regular investing irrespective of market valuations will provide positive long-term returns.

As it is impossible to predict when a market downturn will occur, an exit from the market could result in missing a high-performing period. A buy and hold strategy is prudent compared to one where an investor tries to sell at the top. A market timer would need to be accurate at least 74% of the time to beat the index. Even professional fund managers who attempt to time the market do not have such high accuracy; the increase in trading leads to extra costs compared to a buy and hold investor.

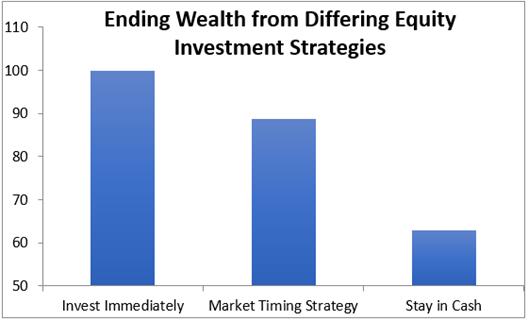

According to a Charles Schwab research project modeled over a 20-year period, an investor who invests $2,000 every year immediately into equities and remains fully invested generates more than an investor who attempts to time the market. Those who stayed in cash (another form of market timing) performed the worst.

(Source: http://dominion-funds.com/en/rss/item/market-timing-waiting-for-godot)

If you are considering investing a large lump sum, it is advisable to split the investment and buy at intervals over a period of time, as we don’t have any confidence about how the market may perform from one day to the next. Thus any possible immediate downward movement in the market does not adversely impact the value of your portfolio.

Concern #3: What do I buy?

Hot stock tips abound from BBQ mates to professional brokers. Before you consider which assets to buy, a broader structuring of the exposure to risk should be determined.

If you have an investment horizon of less than five years, investing may not be appropriate as you may need access to the full capital amount in a short period and may not be able to afford to have any negative growth in your capital. However if you have at least a five-year horizon then you may seek exposure to risk with the expectation of longer-term growth. Although the upside may be high, there is also the risk that the underlying asset can lose value as well.

Thus when your financial adviser considers building an investment portfolio, smart portfolio construction would take into account what level or risk are you willing to take and also what level of risk you need to take to meet your goals. For example, you may be willing to take on a high level of risk because you have a long investment horizon, you are experienced with investment markets and you have reliable income sources. However, it may not be necessary for that investor to have exposure to risky assets if a more conservative portfolio can meet their goals.

Investment assets can be roughly categorised into two classes: growth and defensive assets.

Growth assets include property and equity while defensive assets include cash and bonds (fixed interest). Growth assets are more volatile and although they have better long term growth prospects they can lose a greater proportion of their value. Defensive assets are more conservative, as the value is linked to the income it generates and the underlying value of the asset. Long term growth is generally lower for defensive assets but the downside risk is also reduced. The ratio of growth and defensive assets is a critical choice in the development of an individual’s portfolio.

Approximately 80-90% of investment returns are determined based on this asset allocation. From there, we recommend that well-proven asset classes are sought out (for example international equities from the US, Europe and Australia) while asset classes that are difficult to understand should be avoided. For example, private equity is a high-risk class that may not be suitable for all investors. Financial instruments that are not understood risk not only the initial capital invested, but potentially other assets held in your name.

Summary

- Once you understand what level of risk is appropriate for you then an appropriate growth asset / defensive asset ratio can be established.

- At the next level, be sure to select a well-diversified selection of securities.

- Once a portfolio is designed, consider making regularly scheduled contributions to your investment account to build your funds with the long-term in mind.

- Be mindful of costs. Low-cost solutions can be found if you know where to look.

- Speak with a financial adviser to establish a plan that is suitable for your circumstances as well as your goals.

If you wish to speak to a DPM wealth adviser about starting your investing journey, call 1300 376 376 or book in for a complimentary no-obligation initial consultation.

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.