Salary packaging

Salary packaging is an arrangement between you and your employer that enables you to reduce your taxable salary, and as a result, pay less income tax.

This benefit is restricted to certain occupations such as medical professionals and is also dependent on your employer.

Even though salary packaging allows you to save on your income tax, there are certain calculations where salary packaging needs to be added back to your income; (such as HECS/HELP, Centrelink benefits, Medicare Levy and other Government Entitlements/Benefits) and therefore salary packaging still needs to be reported in your annual income tax return.

It is shown on your Income Statement (previously known as your PAYG Summary) as a Reportable Fringe Benefit (RFB).

The RFB amount listed on your Income Statement doesn’t match the amount that you salary packaged with your employer. This is because the RFB shown on your income statement is the grossed-up taxable value of the reportable benefits provided.

The grossed-up taxable value of a benefit reflects the gross salary that an employee would have to earn to purchase the benefit from after-tax dollars.

In short, the RFB amount represents the ‘value’ of the salary packaging payments made during the year.

The gross up rate for 2018, 2019 and 2020 FBT year (1 April to 31 March) is 1.8868.

Case Study : Salary packaging for Melissa; Doctor in Training, Victoria

Melissa salary packaged the Living Expenses cap of $9,010 and the Meal/Entertainment Benefits cap of $2,650. The grossed-up value that would appear on her Income Statement would be $22,000.

This is calculated as follows:

Living Expenses |

$ 9,010 |

Entertainment Benefits + |

$ 2,650 |

Grossed Up Rate * |

1.8868 |

Reportable Fringe Benefits |

$ 22,000 |

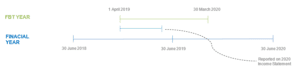

The RFB amount shown on your income statement for an income year (1 July to 30 June) is the grossed-up taxable value of the reportable benefits provided in the previous FBT year (1 April to 31 March).

For example, the RFB amount on your Income Statement for the year ending 30 June 2019 would be the grossed-up taxable value of salary packaged income provided between 1 April 2018 to 31 March 2019.

Please see the graph below.

What happens if you cease employment between 1 April and 30 June?

If you have received salary packaging benefits during this time, your employer must show the RFB amount on your Income Statement for the income tax year ending on 30 June in the following year.

For example, if you stopped working on 1 May 2019, the RFB amount on your Income Statement from your former employer for the year ending 30 June 2020, would be for the salary packaged amounts received between 1 April 2019 – 1 May 2019.

Thus, you may have an Income Statement with an RFB amount listed from a former employer even though you won’t have received any salary or wages from them in that financial year.

Please see the graph below.

To get all the advice you need on salary packaging as well as any other financial advice, book your no-obligation initial consultation or call 1800 376 376.

Also Read Top 5 tips for Salary Packaging in your intern year

Disclaimer: * The information contained in this site is general and is not intended to serve as advice. DPM Financial Services Group recommends you obtain advice concerning specific matters before making a decision.