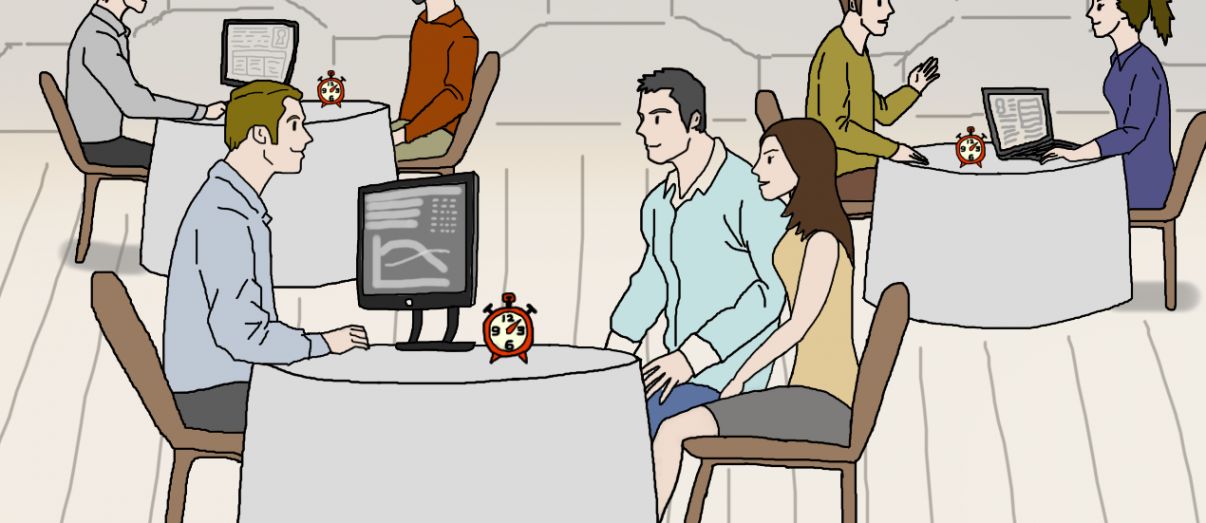

Years ago, as a much younger single man with significantly more hair, I was encouraged by friends to join them on a speed dating event. The opportunity to meet a new lady every 10 minutes, potentially the next Mrs J, was sold to me as a win-win. Worst case scenario, I would be drinking too much and over-indulging on hors-d’oeuvres as we played musical chairs. Best case scenario, I’d finally get my mother off my back and put a stop to her matchmaking escapades.

Years later, older and wiser, I understood that as humans it doesn’t take us long to create first impressions and determine whether the person sitting opposite us can offer us the right relationship. In a world of instant gratification and churn we are no longer interested in spending more time than necessary to achieve our desired objectives.

This brings me to a different type of speed dating you should be considering.

The one with your Banker and/or Broker.

Yes it’s true, since the digital revolution, banks have been discouraging customers from frequenting branches. This was the equivalent of a long distance relationship where sms, whatsapp, facebook, snapchat and the like replaced face-to-face interaction.

After all, one can achieve the same transactions these days without any human interaction. Everything is available on your bank’s mobile app.

We are definitely transacting, but are we talking?

Over the years, despite their analytical knowledge of your spending patterns and which other institutions you’ve been cavorting with, your Bank, believe it or not, has missed seeing your face. And there lies your advantage.

There will never be a better or more prudent time to arrange a ‘speed date’ with your bank, or the sexier, better looking bank sitting across the road. In fact, your financial ‘speed date’ should be arranged at least once every 2-3 years with your Bank and/or Broker.

Because a lot changes in the banking world, and frequently. If you are a mortgage customer or are looking to be one, the most recent changes pushed by the Australian Prudential Regulation Authority (APRA) to guarantee responsible lending has shaken things up even more.

It’s likely that your home loan rates would have moved upwards since you received your last statement. If this is the case, there may be a better structure for your finances that could improve your tax position.

It’s time to check out the other fishes in the sea.

Your financial ‘speed date’ can be arranged in a quick meeting where you’ll have your financial needs assessed. Within 45-60 minutes, you may be lucky enough to meet the bank to be your financial life partner (at least, until your next review). The “one” who will be able to review your financial needs and have you walk away with an approval after the date is over. The one who can refinance/divorce you from your current stale and costly relationship within a week or two. Divorce rates are high in the financial world. The one that will shave a few years or a lazy $20-50K off your mortgage and talk about your tax and superannuation strategies or your early retirement plans. Things that are as important to you as your mortgage.

So tomorrow, log in, print off your loan statements and payslips and go on your financial ‘speed date’. A few basis points and even some cash offers to sweeten the romance and you can walk away satisfied knowing that you’ve had the most productive hour you’ve dedicated to your finances in years. Now how’s that for instant gratification?

To speak with one of our finance specialists please call 1800 376 376 or contact us here.

I need to organise a financial speed date

Disclaimer: * The information contained in this site is general and is not intended to serve as advice as your personal circumstances have not been considered. DPM Financial Services Group recommends you obtain personal advice concerning specific matters before making a decision.