The first home loan deposit scheme explained

Brighten up, there is still hope for first home buyers who have been scrimping and saving in order to generate

Our specialist lending consultants are on hand to help you settle on your dream home or investment property. We’re passionate about supporting you in your home buying journey in a way that suits your personal and unique circumstances.

Are you thinking of buying, refinancing or consolidating debt? Our expert lending team offer insight and support across all your options, securing competitive rates, maximising approval outcomes with expert ongoing support. We act as brokers meaning there’s no fee for our service!

You can book a quick chat with one of our DPM Lending Brokers to discuss your lending requirements and options via the link below.

Borrowing more without LMI means you can:

• Purchase a higher-value property with increased borrowing capacity.

• Keep more cash in your offset account to save interest and access when needed

• Consolidate debts at a lower rate to improve cash flow.

Our specialised lending solution allows allied health professionals to borrow up to 90% of a property’s value without LMI. We work with select lenders who recognise the stability of healthcare professionals, offering superior credit outcomes.

Some financial lenders in Australia may offer loan packages that are tailored to medical and health professionals. The availability and features of these loans can vary between lenders.

Stable employment and a consistent income are both factors that a lender will look at, but making sure you pay your bills on time and in full, minimising your debt, and avoiding defaults are ways you can improve your chances of approval. Having a substantial down payment is also seen as favourable by lenders and may assist you in securing better loan terms.

The amount you can borrow is based on a multitude of factors including your income, financial and employment history, and the lender’s policies. As a health professional you may be eligible to borrow larger amounts when compared to non-health professionals. However, it is important to keep in mind that criteria will vary between banks and institutions and there will be a lot of different factors to consider when choosing a loan.

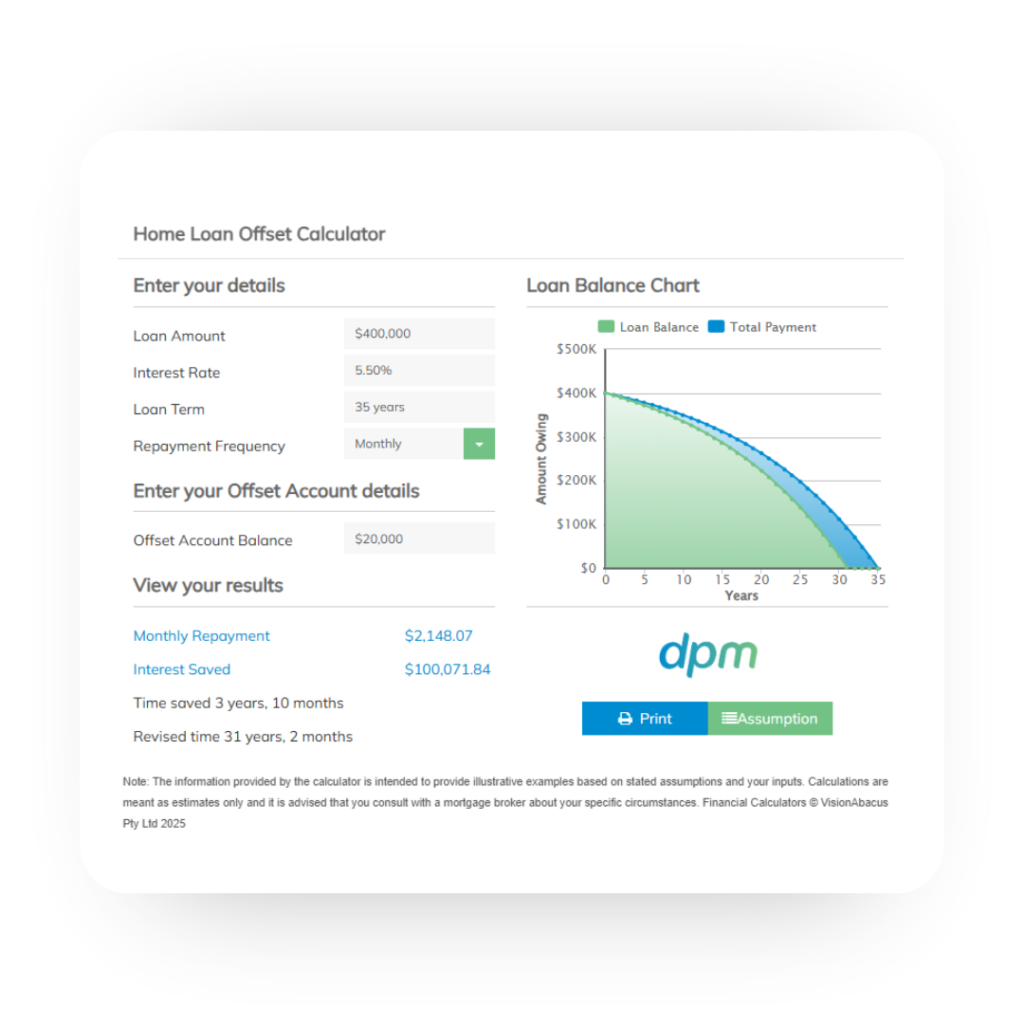

Our suite of lending calculators and budget planners are available free to use to assist you with every step of your decision making process.

service!

service!

Get your free property report emailed today! Access insights for smarter decisions and expert support from DPM lending every step of the way.

Brighten up, there is still hope for first home buyers who have been scrimping and saving in order to generate

Stamp Duty Concessions for First Home Buyers The latest news of a 6% average annual decline to property prices across

Many Australians will choose to buy property at some stage in their lives. Whilst many decide the first house they

Medical professionals often have very unique financial circumstances and requirements, as well as opportunities and options that are often not available to other professions.

We have over 60 years experience handling financial affairs for doctors and medical professionals across Australia. We work holistically to ensure your needs are met across the financial landscape.

16/412 St Kilda Road

Melbourne VIC 3004

PO Box 810

South Melbourne VIC 3205

P: 1800 376 376

Directions

Level 10, 133 Castlereagh Street

Sydney NSW 2000

GPO Box 5391

Sydney NSW 2001

P: 1800 376 376

Directions

DPM acknowledges the Traditional Owners of the land where we live and work. We pay our respects to Elders past, present and emerging, and Elders from other communities we may visit and walk beside. We recognise their connection to Country and their role in caring for and maintaining Country over thousands of years.

Copyright © DPM 2025 | Privacy Policy | Disclaimer | View DPM Financial Services Guide |

View Tax & Accounting Terms & Conditions | Making a complaint

Website by Arthur St