Stamp Duty Concessions for First Home Buyers

The latest news of a 6% average annual decline to property prices across our larger capital cities (Hobart, Adelaide and ACT were actually in positive territory) may have come with a dash of misery for homeowners and investors after years of an upward trend1. However, for first home buyers looking to access the property market this was a welcome trend, particularly as the official median house prices for Melbourne and Sydney for the end of 2017 hovered around $903,000 and $1,180,000 respectively. Median prices for apartments were $736,900 for Sydney and $506,100 for Melbourne for the end of 20172.

For those first home buyers seeking to purchase a unit there is further hope, as median unit prices now fall within the respective state governments’ waiver of land stamp duty for first homebuyers.

Victoria

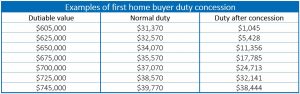

An exemption from land transfer duty has been offered for first home buyers who buy a home with a market value of $600,000 or less. First home buyers buying a home with a market value from $600,001 to $750,000 will also be entitled to a concessional rate of duty, calculated on a sliding scale.

A further sweetener of $10,000 is also provided for those purchasing a new home in metropolitan Melbourne or $20,000 for those purchasing in regional Victoria.

New South Wales

Similar to Victoria but on a higher scale, first home buyers in NSW will no longer have to pay stamp duty on both new and existing homes worth up to $650,000. Stamp duty discounts will also apply to properties worth up to $800,000 as part of a major housing affordability package provided by the NSW Government.

So what does all this entail financially to someone making their first leap into the property market?

Using a purchase in Victoria as an example, the following would apply to most home loan applicants as the minimum required deposit on their home:

The table above does not include the costs of mortgage insurance which can either be funded on top of the loan with most lenders or paid for by the customer. Generally, mortgage insurance can cost between 1.5% to 2.5% of the loan amount depending on the loan value ratio and the underwriting company. Although the premium is paid by borrowers as a one-off upfront fee, the mortgage insurance policy is designed to protect the bank in the event of default by the customer.

For clients who are registered medical practitioners, Certified Public Accountants (CPA) or Engineers, in some instances mortgage insurance can be waived with many banks for loans up to 90% and some for up to 95% of the purchase price.

In summary, it may be possible to purchase a first home having saved $30,000 to $50,000.

With median rents in inner suburbs equating to $385 a week on average ($20,000 per annum) in Melbourne and an average of $550 a week in Sydney ($28,600 per annum)2, many first home buyers are taking advantage of the government assistance to help them enter the property market. The key for these first home buyers is ensuring they have a detailed understanding of their cash flow and they are confident they have the discretionary income available to accommodate the additional monthly loan repayments. In some instances, there may be ways to minimise the cash flow gap between renting and buying a home by letting your finance broker or specialist shop around for better deals. Home loan rates today [October 2018] commence from high 3% to mid 4% depending on the product and structure and a 1% difference to your rate, may be all it takes to make buying your home equivalent to renting from a cashflow perspective.

If you are thinking of buying your first property or need a lending assessment of your borrowing and purchasing power, get in touch with one of our DPM Finance Consultants who can help you see through the fog and discuss the options for your individual situation. Book an initial obligation-free consultation or phone 1800 376 376.

Sources:

1. https://www.domain.com.au/news/melbourne-house-price-declines-to-slow-in-2019-788259

2. https://www.domain.com.au/product/domain-house-price-report-december-2017/

* The information contained in this site is general and is not intended to serve as advice. DPM Financial Services Group recommends you obtain advice concerning specific matters before making a decision.